Unlocking Public-Private Collaboration to Speed Housing Delivery

AUTHORS: Rebecca Foster, Kati Vastola, and Michael Saadine

Key Points

- The San Francisco Housing Accelerator Fund is an example of a new way to blend public and private funding. It was founded with an initial $20 million investment from the City of San Francisco.

- The Fund has since raised over $450 million in capital, including $430 million from non-city sources. It is a Community Development Financial Institution and has developed award-winning housing.

- Cities are adopting and adapting the housing accelerator fund model for their own environments, including the Philadelphia Accelerator Fund and the Austin Housing Accelerator Loan Fund.

Communities across the country face significant obstacles to delivering affordable housing, due to sluggish bureaucratic funding processes that lack the agility to adapt to changing market dynamics or meet the scale of the problem. Addressing these challenges requires innovative, flexible financing solutions capable of rapid response and scalability.

Public-private collaboration can effectively deploy public, private, and philanthropic capital to accelerate affordable housing production and preservation, in close partnership with local governments, to help achieve ambitious and crucial affordable housing development goals. Communities interested in the benefits of public-private partnership have several models and approaches to choose from. This includes structuring the partnership via a memorandum of understanding between existing organizations, hosting the partnership within an existing organization, or setting up a standalone entity with its own balance sheet and governance structure. Standalone public-private collaborations often require more time, effort, and resources to set up compared to other approaches. Once launched, however, they offer communities a durable, flexible, scalable tool for achieving a range of affordable housing outcomes.

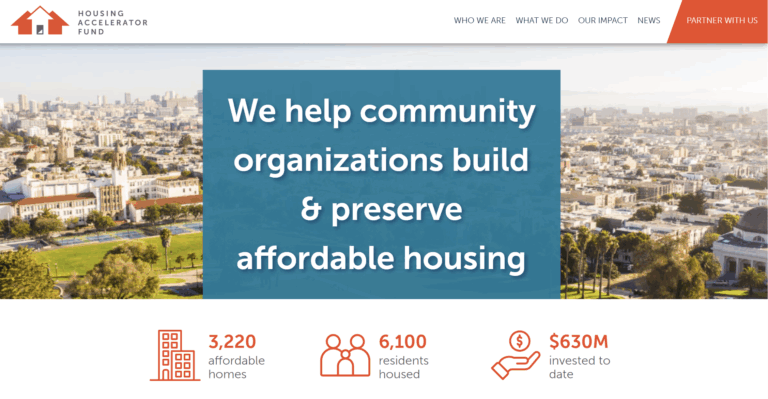

The San Francisco Housing Accelerator Fund (HAF) exemplifies the public-private collaboration. Initially incubated within the San Francisco’s Mayor’s Office, HAF began making loans in 2017 and has since evolved into an independent nonprofit and Community Development Financial Institution (CDFI). The organization was originally capitalized through a $10 million, 20-year, firstloss subordinate loan from the City of San Francisco, which was later increased to $20 million in 2019. Now in its ninth year of operations, HAF has raised over $450 million in capital, including $430 million from non-City sources. San Francisco’s public investment has been leveraged at a ratio exceeding 20:1, demonstrating the catalytic power of public-private partnerships.

HAF now offers a diverse range of financial products including acquisition and pre-development, construction and rehabilitation, and permanent financing for the development and preservation of affordable housing. To date, HAF has committed over $600 million in project investments in its hometown of San Francisco and surrounding communities, funding more than 3,000 affordable homes. HAF is a compelling example of how a standalone public-private partnership can be successfully launched, scaled, and adapted over time to meet evolving priorities in affordable housing production and preservation.

The Challenge This Tool Solves

Well-structured, standalone, affordable housing-focused public-private partnerships create shared platforms where public agencies, philanthropic funders, and private and nonprofit partners align goals, pool resources, and move capital nimbly. These entities can take on the work of designing and deploying customized financing solutions that are responsive to local needs and enable more equitable development. They can absorb risk, reduce transaction timelines, and tailor underwriting standards to mission-driven outcomes — unlocking projects that would otherwise stall or fail. In doing so, they provide a vehicle for policy innovation, regional coordination, and scaled preservation and production of affordable housing.

The key benefits of this structure include:

- Leverage: Pooling diverse capital sources into coordinated, flexible investment strategies;

- Speed: Providing swift, market-responsive financing for property acquisition and preservation; and

- Innovation: Encouraging innovative and proactive solutions to affordable housing finance challenges.

Types of Communities That Could Use This Tool

Most communities facing affordable housing shortages encounter a common problem: public financing for affordable housing is often bureaucratic, siloed, and slow to deploy. This prevents developers from accessing capital quickly enough to compete in real estate markets, causing missed opportunities and increased costs as they assemble complex capital stacks. While public-private approaches can aggregate and distribute capital more effectively, they require both dedicated public-sector partners (even if they are often slow to get out into projects and encumbered by a lot of regulatory burden), and interested private and philanthropic capital sources (even if they lack a clear one-stop-place to invest).

Public-private partnerships, structured as independent nonprofits with their own capital stack, may prove particularly valuable when a community faces additional challenges, including:

- Complex, Evolving Local Markets: Requires an on-the-ground partner with the capacity to understand nuanced conditions and agility to address them;

- Need for New Financial Products: Especially if the need is ambiguous and the product terms require refinement;

- Gaps in Existing Lending: Established lenders may lack motivation to take on product innovation, increased volume, and/or new risks the community needs; and

- Developers with Inadequate Financial Capacity: There are partners motivated to serve as developers, owners, and operators, but they do not have the financial capacity and complexity to move on opportunities independently.

Expected Impacts of This Tool

Communities facing the challenges and conditions described above, and that invest in creating an independent public-private partnership (such as the Housing Accelerator Fund, profiled below), can expect to see:

- Rapid Increase in Affordable Housing Stock: Accelerated development and preservation timelines;

- Enhanced Capital Attraction: New inflows from a diverse range of investors, including private banks, foundations, and individual philanthropists;

- Cost Efficiency: Significant savings achieved by reducing regulatory burdens, increasing access to advantageous capital, and accelerating the speed of delivery. Additionally, innovative construction techniques are often easier to finance through a public-private collaboration like the HAF, generating further savings alongside sustainability enhancement;

- Increased Community Stability: Reduced homelessness and displacement through preservation of naturally occurring affordable housing and proactive development strategies; and

- Long-Term Adaptability: Flexible, durable tool can evolve with changing market conditions and community needs.

Predecessor: NYC Acquisition Fund

In 2006, New York City launched the NYC Acquisition Fund, one of the first innovative affordable housing partnerships, to address a critical challenge: by the 2000s, the City had depleted its supply of tax-foreclosed properties carried forward since the 1970s that were traditionally transferred to mission-driven developers. Developers now needed to compete in a hot real estate market to secure development sites but lacked sufficient financial resources to do so.

Traditional public financing was too slow, and financing terms available from private lenders to fund early-stage acquisitions were too restrictive. In response, the City partnered with Enterprise Community Partners, LISC, Forsyth Street, and foundations to create a revolving loan fund blending public guarantees with private capital to deliver fast, flexible acquisition loans at the scale needed to sustain the City’s affordable housing pipeline.

The Fund offered a new model providing tailored bridge financing that allowed affordable housing developers to act quickly, with high loan-to-value ratios covering property acquisition and predevelopment costs, generous maximum loan sizes to support large and costly property acquisitions, and other terms calibrated for affordable and supportive housing projects in high-cost markets. Since launch, the Fund has helped create or preserve over 16,000 affordable homes and established a national model cities could adopt for capital and policy alignment to drive equitable housing development.

Structured as an LLC co-owned by Enterprise and LISC, the Fund operates through a credit committee, on which the fund’s owners, lenders, and the City are represented. Day-to-day fund management services are provided by Forsyth Street. A network of six community development financial institutions (CDFIs) originate loans into the Fund, leveraging the trusted, long-term relationships that those CDFIs have built with the developer community. Public and philanthropic capital expand the flexibility of the Fund’s loan product terms, and private capital from a bank lender syndicate provides scale.

Housing Accelerator Fund

In 2014, San Francisco Mayor Ed Lee convened a Housing Working Group highlighting the urgent need for innovative solutions in housing finance. Building on NYC’s Acquisition Fund, the City created the Housing Accelerator Fund (HAF), with greater flexibility and expanded capability.

Organizational Structure, Staffing, and Governance: Whereas the NYC Acquisition Fund delegates loan origination to six existing CDFIs, the San Francisco Housing Accelerator Fund would make loans directly to borrowers. Moreover, the new loan fund would be an independent nonprofit, with the flexibility to provide financing not only for acquisition and predevelopment, but for needs across all project phases. Structuring HAF this way expanded its flexibility beyond what would be possible if it were to be owned by and originating loans through existing CDFIs. This approach also positioned the HAF for future scalability and versatility, conferring independent control that allows HAF to combine financing sources to increase efficiency, move quickly and nimbly, and think innovatively.

HAF’s governance and capital stack are structured to secure partner confidence while allowing this independence. HAF is governed by an independent board of directors comprised of individuals with expertise in housing, finance, philanthropy, and community development, with the City holding ex officio seats.

Capitalization: HAF sought to design a capital structure that balanced the flexibility and scale offered by philanthropic and private capital with the security and risk protections those investors would require. Supporting this structure, an intercreditor agreement lays out the “loss waterfall”, establishing the order in which different lenders or classes of debt are repaid—or bear losses—in the event of default or liquidation. Moreover, it provides a mechanism for new investors to join the fund while preserving the rights, priorities, and risk positions of existing investors.

To launch the HAF, the City approved a $10 million 20-year 0% subordinate investment. The loan administered by the Mayor’s Office of Housing and Community Development, which maintains a close working relationship with the HAF for collaborative affordable housing pipeline management. As a subordinate investment, it serves as a backstop for the rest of the capital stack. This structure allowed HAF to utilize the City of San Francisco’s initial investment into HAF to serve as “top loss” capital before HAF had any equity on its balance sheet. (Since launch, HAF has grown equity through retained earnings and grants to the loan fund, which provide even more security to other investors).

Alongside the City, HAF’s earliest investors included the San Francisco Foundation, Dignity Health, the Hewlett Foundation, and Citibank, on both the Community Capital and Community Development side (press coverage here and here).

Scaling the HAF

HAF has grown remarkably from its $37 million initial capitalization to over $300 million today (averaging ~70% committed). It has expanded geographically beyond San Francisco throughout the Greater Bay Area. Further, HAF has successfully scaled its portfolio of financial products and now offers loans across all phases of affordable housing development. This includes innovative tools focused on specific gaps in affordable housing delivery, such as the Bay Area Housing Innovation Fund and Industrialized Construction Catalyst Fund.

As an independent public-private entity that built its own balance sheet, HAF blends public, private, and philanthropic capital into a mission-aligned platform for housing preservation and production.

This structure allows HAF to move quickly and tailor financing products to evolving affordable housing gaps. By strategically layering capital, HAF reduces risk for private investors while preserving affordability outcomes. Its unique governance and capital model de-risks transactions, accelerates execution, and enables a broader range of stakeholders to participate confidently in affordable housing solutions.

HAF offers private investors a range of positions on its capital stack, tailored to different risk-return profiles, including:

- Project-Level recourse / Off-Balance Sheet Facilities:

- Federal Home Loan Bank (FHLB) access: HAF became a member of the San Francisco FHLB two years ago, gaining the ability to pledge assets (stabilized project loans or securities) and borrow competitively priced advances up to a percentage of the asset valuation. Each FHLB has its own terms and rules for CDFI borrowing, and until recently the max borrowing term for CDFIs in the San Francisco region was up to five years. However, the San Francisco FHLB recently extended eligible borrowing terms in specific instances for CDFIs up to a maximum term of 20 years, which should meaningfully impact HAF’s ability to provide permanent loans to the affordable housing market in its region.

- Bank revolving lending facility (“Senior Secured”): This facility provides 60–80% of financing for eligible projects. This senior debt is secured by a first-position deed of trust on the underlying property, and all draws do not have recourse to HAF’s balance sheet, meaning they do not have rights to claim the assets off the balance sheet. This facility is priced at a spread to the Secured Overnight Financing Rate (between 1.5% to 2.5% spread) depending on the bank partner. Pricing is fixed at draw from the facility.

- On-Balance Sheet / Recourse to HAF Investments: Investment categories include:

- Senior Investments: Predominantly banks and institutional investors, with typical interest rates ranging from 2.5% to 5%.

- Mezzanine Investments: Structured for mission-aligned investors such as foundations and health systems, also including some banks. Typical interest rates are below 3%.

These investments are anchored by over $20 million in subordinate loan capital, including the previously mentioned 0% interest, 20-year first loss loan from the City of San Francisco, $60 million in philanthropic grants, and retained earnings. This deep subordination enhances the likelihood of repayment for private and institutional investors. Largely due to underwriting to the public sector takeout, these loans have seen zero losses to date.

Crucially, HAF underwrites many of its loans to a committed future public financing source that will repay HAF loans. Nearly all projects financed by HAF include a future commitment from the City of San Francisco or another public agency to provide permanent financing once affordability restrictions are in place. The City has never failed to complete its financing and HAF loan payback on a deed-restricted affordable housing project, and every HAF loan includes a permanent affordability deed restriction at closing, significantly reducing long-term repayment risk and enhancing investor confidence. HAF takes on the time-sensitive, hands-on phase of the deal and bridges to the timeline in which public financing can participate. Real estate risk and public finance risk are distinct risks which are often blended in complex projects; HAF disaggregates these risks to reduce complexity.

This structure enables HAF to tap into capital sources underutilized in affordable housing. For example, a partnership between HAF and the San Francisco Foundation channels donor-advised funds into an ultra-low-cost loan to the HAF (with an interest rate below 1.0%), which the HAF then leverages alongside its other balance sheet capital. The Home for Good Fund is a revolving DAF facility with a 5- or 10- year repayment date to donors, designed to accelerate housing solutions in donors’ “backyard” while maintaining their future giving optionality. Over $30 million has been raised through this structure to date.

Diffusion and Scaling the Housing Accelerator Fund

Effectively scaling the Housing Accelerator Fund model requires:

- Public Sector Alignment and Commitment: Active engagement and sustained financial commitment from local governments are crucial.

- Cross-Sector Collaboration: Establish robust partnerships among public entities, private capital providers, and philanthropic organizations.

- Capacity-Building: Invest in developing local development expertise through training, technical assistance, and shared learning initiatives.

- Continuous Innovation and Adaptation: Regularly assessing local market conditions and investor requirements and adjusting financial products and strategies accordingly.

HAF’s success in San Francisco and its ongoing expansion throughout the Bay Area underscore the model’s replicability for affordable housing delivery nationwide. Jurisdictions facing affordable housing crises can benefit from adopting and adapting the HAF model to their local contexts, creating rapid, scalable, and sustainable impacts on the affordable housing crisis. The HAF model is also being developed and implemented in other jurisdictions. Philadelphia’s Accelerator Fund (PAF) was established in 2019 and operational by 2021. Philadelphia adopted a public-private model; PAF is structured as an independent nonprofit loan fund that coordinates with city agencies but remains beyond city governance. PAF works to both increase affordable housing supply and empower minority developers, with predevelopment loans, acquisition loans, subordinate debt, and construction financing. PAF also offers targeted support services for Black and Brown developers.

More recently, Austin launched a Housing Accelerator Loan Fund (AHALF). This fund is likewise a public-private structure, managed by an existing nonprofit, the Austin Community Foundation. The fund pursues new construction and preservation of affordable housing primarily via short-term, low-cost loans for predevelopment, land acquisition, and construction bridging. AHALF sees itself as filling a gap in funding sources and accelerating the pace of building affordable units.

In Cleveland, the city recently launched the Cleveland Housing Investment Fund (CHIF), an innovative and catalytic public-private partnership between the City of Cleveland, Cleveland LISC, and Key Bank. CHIF’s goal is to create between 2,500 and 3,000 affordable housing units over the next 10 years. Like AHALF, the CHIF program is housed at an existing organization — LISC —to provide a stable foundation for flexible capital.

Austin, Cleveland, and Philadelphia’s efforts, like the San Francisco HAF, seek to increase the speed of affordable housing delivery, leveraging the flexibility of the private sector while staying in concert with the public sector’s goals, and future work of the Task Force will highlight these programs in more depth.