Mixed-Income Development Model: Montgomery County, Chicago, Atlanta, and Chattanooga Case Study

Mixed-Income Public Development Model: Local Housing Finance Agency Innovation

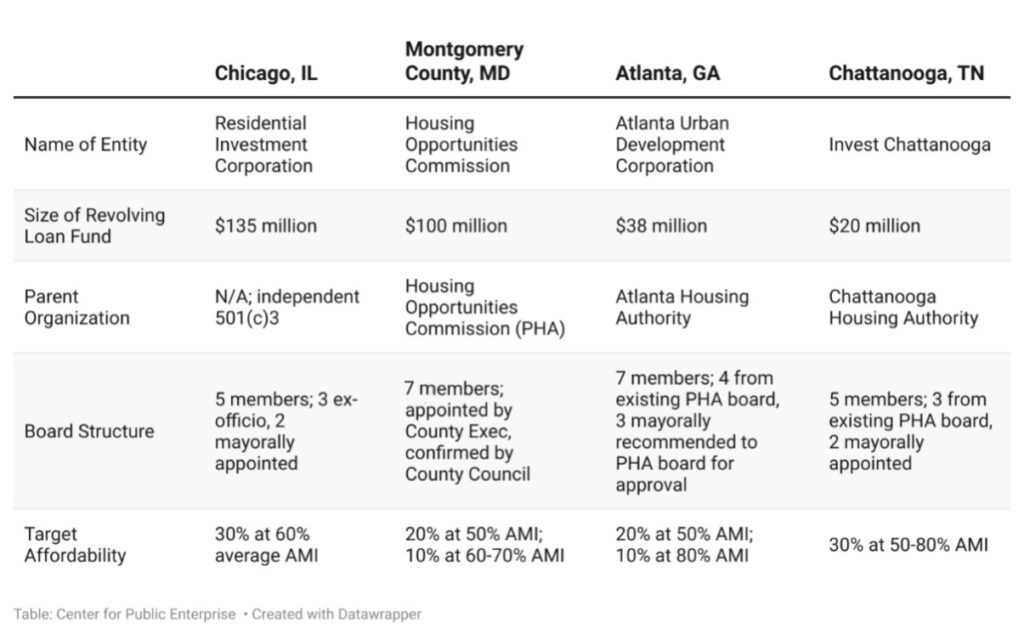

As of the time of publication, at least four communities are actively implementing the mixed-income public development model, with numerous other localities and states exploring similar implementations.

These four jurisdictions are all building out their development pipelines of potential projects through various methods: identifying stalled private market projects in need of financing, building out projects on public land, and creating off ramps for prospective LIHTC projects that do not receive allocations in a given year.

Montgomery County Housing Opportunities Commission’s award-winning Housing Production Fund launched in 2021 when the Montgomery County Council authorized a $50 million, 20-year taxable bond issuance by HOC, backed by an annual appropriation from the County budget. The taxable structure allows for more flexibility than tax-exempt bonds, though other jurisdictions may find tax-exempt structures more favorable.

HOC issues HPF loans to projects at five percent interest, ensuring sufficient return to help reduce the costs of the bond issuance that initially capitalized the fund. Due to the model’s success, the County authorized a second bond offering in 2022, bringing the total size of the HPF to $100 million and increasing the number of units HOC expects to produce over the life of the bonds in the coming years up to 5,000-6,000. Because the HPF only provides roughly 20 percent of the construction cost in each project and is repaid at conversion to permanent financing (roughly every five years), a $100 million fund could theoretically support up to $1 billion of total development over 10 years. The fund is revolving because the repaid funds are subsequently used to assist with funding the next projects. All of this costs the County only about $2.7 million per year in net costs. Other cities around the country have taken note: Atlanta, Chicago, and Chattanooga have all authorized similar revolving loan funds, representing a total of $239 million in investment.

Acquisition Model: Los Angeles

The Housing Authority of the City of Los Angeles’s (HACLA) acquisitions program focuses on preserving affordability and expanding housing supply by purchasing existing market-rate properties and converting them to affordable housing by adding long-term income and rent limit covenants. These restrictions vary by property, structured according to each property’s unique profile, and take effect at unit turnover, avoiding displacement of existing residents – although

existing residents who qualify are encouraged to certify and may benefit from rent reductions.

HACLA’s competitive edge in the market includes access to tax-exempt debt financing that allows for favorable terms compared to typical market buyers. HACLA recently created its own Acquisition Equity Fund, which combines mortgage revenue bonds, philanthropic funds, and governmental grants and loans to finance property purchases.

Potential acquisitions are sourced through owner and broker referrals, with HACLA staff prioritizing properties based on factors such as unit mix, age, and location. HACLA places a high priority on newer properties with 200+ units in high resource areas designated by the State of California. Since 2020, HACLA has acquired over 2,000 housing units through its Acquisition Program. HACLA is actively exploring models to finance the construction of new mixed-income

properties using governmental bonds and public equity funds.