As state and local governments assume greater responsibility for affordable housing production and preservation, innovative tax incentive programs have emerged nationwide. The following examples highlight effective approaches from Texas, Atlanta, and Chattanooga.

Case Study

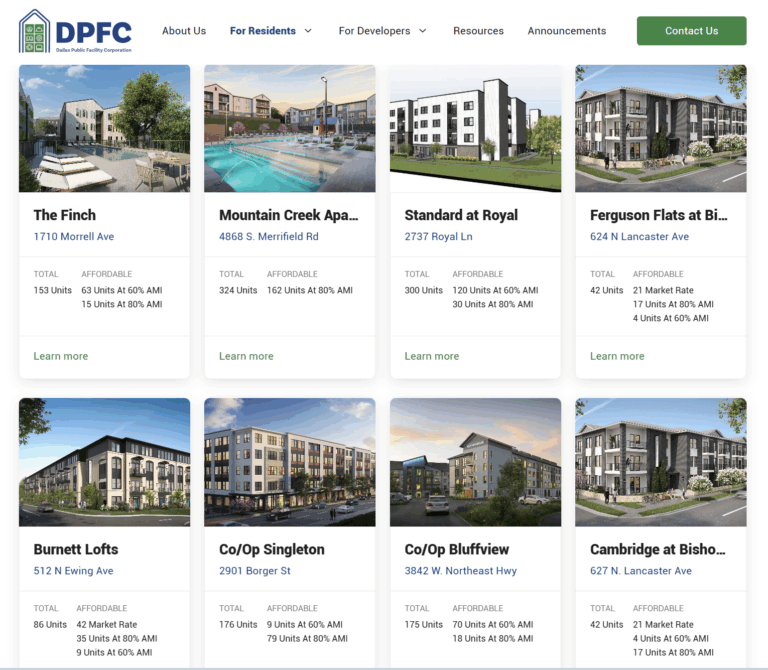

Texas’s Public Facility Corporations

"Right-Sizing" Property Tax Incentives to Increase Housing Affordability

In 2015, Texas implemented a unique multifamily tax exemption program. Facilitated under Texas Local Government Code, Texas is one of the first places to provide this form of incentive to create affordable housing and, as a result, it has had opportunities to refine the program towards ensuring it accomplishes its intended public purpose over time.

Read More About Texas’s Public Facility Corporations

Case Study

Atlanta’s Private Enterprise Agreement

"Right-Sizing" Property Tax Incentives to Increase Housing Affordability

In 2023, as part of Mayor Dickens’s pledge to create 20,000 affordable housing units, Atlanta established the Atlanta Urban Development Corporation (“AUDC”). Beyond functioning as a “European style” public developer, AUDC created a program leveraging the Private Enterprise Agreement (PEA), found in the original 1937 Georgia Housing Authorities Law, to provide tax exemptions to projects that provide a minimum number of affordable units.

Read More About Atlanta’s Private Enterprise Agreement

Case Study

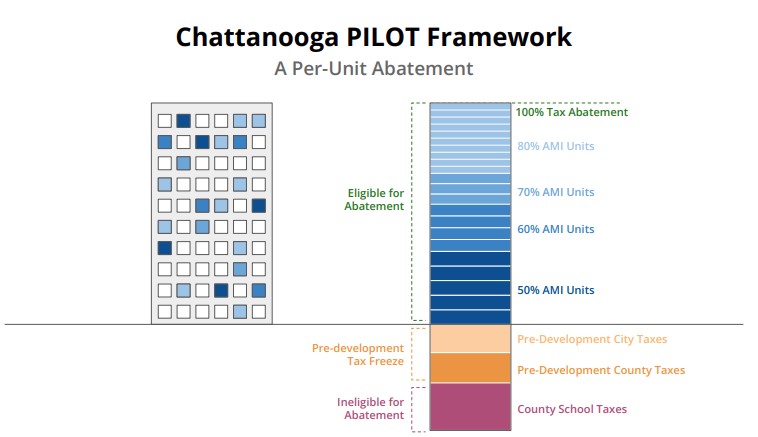

Chattanooga’s PILOT Program

"Right-Sizing" Property Tax Incentives to Increase Housing Affordability

Chattanooga recently instituted a Payment in Lieu of Taxes (PILOT) program to offer developers a 15-year tax abatement commensurate to the number of affordable units created. Similar to Atlanta and Texas, the PILOT is enacted through a ground lease between a public entity, the Health Education and Housing Facilities Board, and a private or nonprofit real estate operator.

Read More About Chattanooga’s PILOT Program